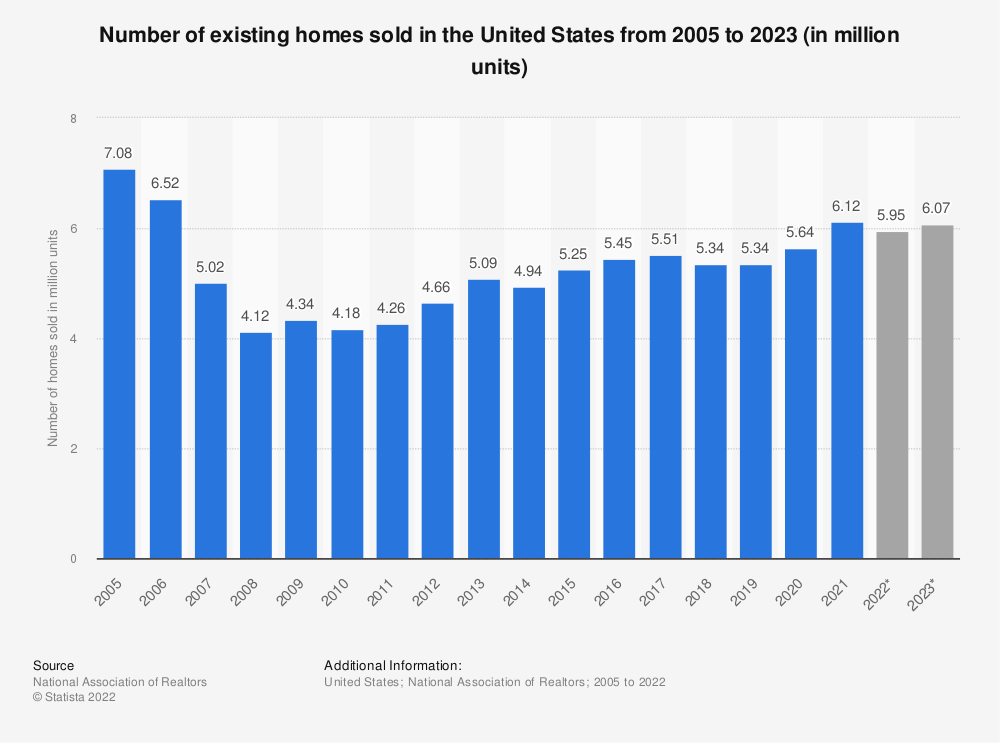

In 2021, there were 6.9 million home sales in the U.S. and this figure was projected to increase to seven million by 2023. The number of home sales has steadily risen since 2011, except for two slight dips in 2014 and in 2018.

Selling your home is an important and stressful life event. A new job opportunity, growing family situation, sudden divorce or another major life event can be a compelling reason to sell your home and move elsewhere.

No matter what the reason for sale is, you should be aware of possible tax implications.

Before moving on to a discussion of possible tax consequences, it is very important to define “main home” (or “primary residence”) concept.

According to IRS, an individual has only one main home at a time. If you own and live in just one home, then that property is your main home. If you own or live in more than one home, then you must apply a “facts and circumstances” test to determine which property is your main home. While the most important factor is where you spend the most time, other factors can be relevant as well.

If you have a capital gain from the sale of your main home, you may be eligible to exclude gain from sale up to $250,000 ($500,000 for married filing jointly).

- Ownership Test

- Residence Test

- Look-Back Test

Please note, that it is not enough to meet either one of them, you have to meet all three tests to qualify.

If you owned the home for at least 2 years (24 months) out of the last 5 years before the date of actual sale/closing, you meet the ownership test.

If you owned the home and used it as your residence for at least 2 years (24 months), either consecutive or not, out of previous 5 years, you meet the residence requirement.

A vacation or other short absence counts as time you lived at home (even if you rented out your home while you were gone).

Look-Back test allows you to take the exclusion only once during 2-years period. In other words, you meet the look-back requirement if you didn’t sell another home during the 2-years period (or, if you did sale another home, you didn’t take an exclusion).

If you don’t meet one or more of the three eligibility tests, you may still qualify for a partial exclusion of gain.

You can meet the requirements for a partial exclusion if the main reason for your home sale was a change of your work location, a health issue or an unforeseeable event.

Work-related move can make you eligible for partial exclusion in the following cases:

- Your or your spouse new workplace is located at least 50 miles from your previous work location (please, note the distance is from the former work location, not from your home)

- You or your spouse began a new job at least 50 miles from your home and you/your spouse had no previous work location

Health-related move occurred when:

- You moved to obtain, provide, facilitate diagnosis, cure, mitigation or treatment of disease/illness/injury for yourself or family member

- A doctor recommended a change in residence for you because you were experiencing a health problem

Unforeseeable events:

- Your home was destroyed or condemned

- Your home has suffered a casualty loss because of natural or human-made disaster or act of terrorism

- You/your spouse became divorced or legally separated, or gave birth to two or more children from the same pregnancy, or became eligible for unemployment compensation, or became unable to pay basic living expenses because of change in employment status, or died.

Please, note, that you can increase your initial basis in your property (i.e., price you paid for you home) by some closing and settlement fees as well as cost of improvements.

Capital gain is difference between the price you sell your home for and your home’s adjusted basis.

The process of figuring out adjusted basis can rarely be completely straightforward.

You may want to consult an experienced tax professional, who can help you in maximizing your tax benefits.

0 Comments